DETO: How You Can Invest Through Liquidity Mining, Staking, and More

Delta Exchange is a crypto derivatives exchange where traders can trade in options, futures, and interest rate swaps on Bitcoin and 50 other altcoins with up to 100x leverage. It offers several innovative products unique in themselves, including Turbo Options, Calender Spreads, etc. The exchange strives to develop itself as the most liquid, advanced, and recognized crypto derivatives exchange for both institutional and retail investors in the market. It has a user base of more than 27,000 registered users active on the platform.

DETO is the native token of the exchange, with several functionalities and use cases. Before we begin exploring the investment routes for DETO available on Delta Exchange, let’s first grab some insights on what makes DETO much more than a native token.

What is DETO?

DETO is an ERC-20 based utility and rewards token integral to the exchange. DETO is the life force behind the current incentive plans for active traders and liquidity providers in the Delta ecosystem. Interestingly, the DETO’s tokenomics directly consequence in the growth of the exchange. The DETO driven incentives add to the existing liquidity and trading volumes at the exchange, increasing the value of DETO based rewards. Some of its utilities include:

● Traders can pay 25% of their trading fees in DETO. Traders can buy DETO below MSP(Minimum Selling rice) and realize a higher price by using DETO to pay trading fees.

● DETO can also be used as collateral for margin trading on the exchange. The traders can margin positions in DETO while the settlement would take place in BTC or USDT only.

● DETO will have its own line of products structured and fitted around it. These products will be exclusively margined and settled in DETO.

● Delta exchange has a DETO denominated insurance pool where DETO holders will be able to stake and earn yield.

● Delta has developed an extensive DETO rewards program to incentivize the traders who participate in trading and other aspects of Delta. Around 20% of the DETO supply (or 100 million DETO) have been committed to the rewards pool to be distributed for a period of 12-18 months. Traders will be given daily DETO rewards for participating in farming, mining, and staking on Delta exchange. Let’s explore these rewards programs under the investment section further.

How can You Earn and Invest in DETO on Delta Exchange?

Delta offers delta-exclusive strategies and reward programs that traders can opt for to start investing in DETO and enjoy its utilities:

#1 Staking

The staking program is primarily used to set up the DETO denominated pool on the lines of BTC and USDT denominated pools already active on the platform. All the DETO holders will be able to stake their DETO into the pool and earn yields. Staking DETO tokens will be beneficial to the traders and the platform in two ways.

● Firstly, it would help reduce the circulating supply of DETO, increasing the worth of each DETO token.

● Secondly, the resultant insurance fund will attract other large trading firms and funds to trade on the exchange. The current Annual Percentage Yield (APY) on the DETO staking pool is 16%.

Delta has further plans to launch risk-free deposit schemes aimed at reducing the circulating supply of DETO. Traders should note that the staking yield from the DETO insurance pool will be higher than the returns from the deposit schemes.

#2 Liquidity Mining

The traders aren’t required to do or follow any particular tasks to start mining DETO on the exchange. They just need to continue doing what they do, i.e., trading on the exchange. The mined DETO tokens would be proportionally credited to their wallet based on their share of capital deployed in the trading pools as they trade on the platform. Liquidity mining can be initiated via robo trading strategies active on Delta exchange.

Delta exchange has several robo trading strategies available for its users where the users can deploy their capital into automated trading strategies that run on predetermined algorithms. These robo strategies include AMMs (Automated Market Makers) and trend-following algos. The traders can suit any robo strategy best suited to them to mine DETO while simultaneously earning potential yield from the strategy. To know more about robo strategies and how to start trading with them, click here.

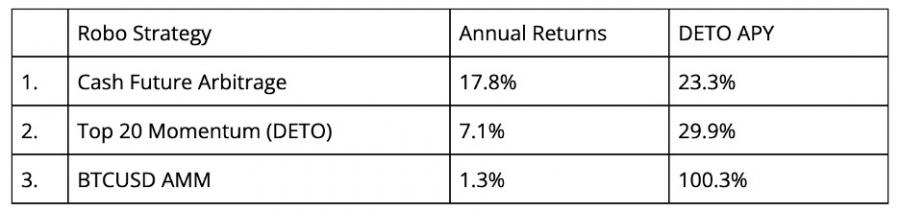

As of now, Delta offers a DETO APY of 21.8% on the Large Cap AMM(USDT) robo strategy, which has returns of 9.7%. The DETO exclusive Large Cap AMM strategy offers returns up to 6.9% and a DETO APY of 28%. Similarly, the other robo strategies offer the following DETO rewards:

#3 Referral Mining

Under the referral mining program, the traders on the exchange can also earn DETO on the trading activities of their referred users. The daily rewards on the referral mining programs will be distributed among the traders based on the proportion of trading volumes generated by their referred users.

#4 Trade Farming

Under trade farming, traders can earn DETO by trading on the exchange. Their proportion of rewards from the daily farming rewards pool will depend on their daily trading volume on the exchange. All the traders registered on the exchange will become automatically eligible for trade farming rewards. This feature is yet to be active on the exchange.

#5 DETO Buyback Program

Under the buyback program, 25% of the trading fees earned on the platform would be used to buy freely circulating DETO, thereby reducing its supply. The DETO buyback program was launched in June 2021. The program will continue until at least 50% of the hard cap, i.e., 375 million DETO, will have been bought back. The bought-back DETO will be funneled back to the rewards pool to push forward the platform’s growth.

Via this virtuous growth loop created by leveraging DETO, every trader who holds or invests in DETO will be benefited.

At the macro level, the consequent growth of the platform would drive more contributors and traders onto the platform leading to an increase in trade volumes and revenues. This increase in revenues means more buying back of DETO and better replenishment of the rewards pool, better liquidity, and greater worth of the DETO token after each cycle of the loop.

Traders can earn both passive and active income by investing in DETO and, in return, can add to the viability and growth of the platform. It’s a win-win situation for all!

Don’t wait for luck bells to toll. Grab your trading lens, head over to Delta Exchange to invest in DETO, and earn your luck.

Previous Press Releases:

- Day 5 Highlights of Landmark Kleiman v Wright Trial

- ANFS ‘s High Performance Blockchain Consensus HPOS Launched to Increase Operational Efficiency And Scalability Of Blockchain Networks

- Contracoin CRE Cryptocurrency Makes U.S. Debut, Blockchain-Powered Platform Serves as Bridge Between Cryptocurrency, Real Estate Markets

Next Press Releases: